Crecimiento económico e inclusión social: el caso del Perú

¿Qué factores determinan la violencia doméstica de pareja y su recurrencia en el Perú? (Fact Violencia)

Reforma política en Perú: propuestas, retos y estrategias para su implementación

Crecimiento económico e inclusión social: el caso del Perú

Reforma política en Perú: propuestas, retos y estrategias para su implementación

Lucha contra la pobreza: Agenda mínima para acción urgente

Universidades

- Pontificia Universidad Católica del Perú, Departamento de Economía

- Universidad Antonio Ruíz de Montoya

- Universidad de Lima

- Universidad San Martín de Porres, Instituto del Perú

- Universidad del Pacífico, Centro de Investigación

- Universidad Esan

- Universidad Nacional Agraria La Molina

- Universidad Nacional de Ingeniería

- Universidad Nacional del Callao

- Universidad Nacional Mayor de San Marcos

- Universidad Peruana Cayetano Heredia

- Universidad Peruana de Ciencias Aplicadas

- Universidad Católica Sedes Sapientiae

- Universidad San Ignacio de Loyola

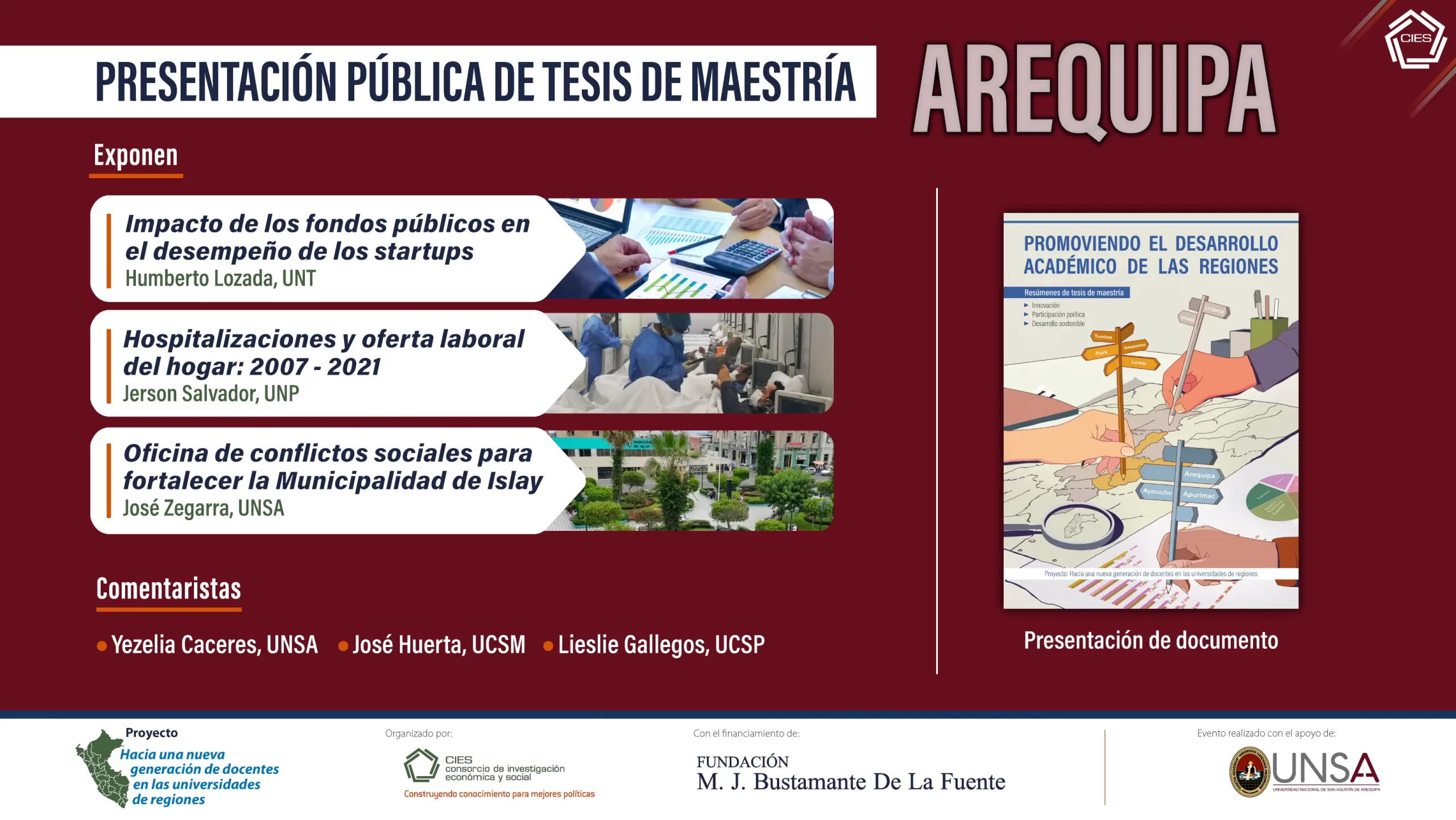

- Universidad Católica de Santa María, Arequipa

- Universidad Católica San Pablo, Arequipa

- Universidad Católica Santo Toribio de Mogrovejo, Lambayeque

- Universidad de Piura

- Universidad Nacional de Cajamarca

- Universidad Nacional de la Amazonía Peruana, Loreto

- Universidad Nacional de Piura

- Universidad Nacional de San Agustín de Arequipa

- Universidad Nacional de San Cristobal de Huamanga, Ayacucho

- Universidad Nacional de Trujillo, La Libertad

- Universidad Nacional del Altiplano, Puno

- Universidad Nacional del Centro del Perú, Junín

- Universidad Nacional San Antonio Abad del Cusco

- Universidad Nacional Santiago Antunez de Mayolo, Ancash

- Universidad Nacional Toribio Rodríguez de Mendoza de Amazonas

Centros

- Asociación Benéfica Prisma

- Centro de Estudios para el Desarrollo y la Participación-CEDEP

- Centro de Estudios y Promoción del Desarrollo-DESCO

- Centro Peruano de Estudios Sociales-CEPES

- Grupo de Análisis para el Desarrollo-GRADE

- Apoyo Consultoría

- Instituto de Estudios Peruanos-IEP

- Instituto Nacional de Estadística e Informática-INEI

- Instituto Peruano de Acción Empresarial - IPAE

- Instituto Peruano de Economía - IPE

- Macroconsult

- Seguimiento, Análisis y Evaluación para el Desarrollo-SASE

- Servicios Educativos Rurales- SER

- Sociedad Peruana de Derecho Ambiental-SPDA

- Practical Action